Financial Services, Pensions, Taxation Services

Budget 2016 Summary & Analysis

Budget 2016 Summary & Analysis

- No change in pension tax relief limits

Opportunity before Pay & File ROS deadline of the 12th of November (or 31st of October for others), to backdate personal pension contributions to 2014 and obtain tax relief at 41% (for higher rate taxpayers within the usual limits for 2014) instead of 40% in 2015.

- Confirmation that the pension levy has ended

Confirmation that the pension levy will not apply beyond 2015 and so the final payment of 0.15% applying at 30th of June 2015 values.

- Increase in the State Pension of €3 per week

This is the first increase since 2009. Brings the maximum State Contributory Pension to €233.30 per week or €12,132 pa.

- Increase in Capital Acquisitions Tax (CAT) Class A Threshold from €225,000 to €280,000.

- While welcome, Inheritance Tax liabilities are still significantly higher than in 2009.

- The Class B and C thresholds of €30,150 and €15,075 respectively have not been increased.

- No change in CAT tax rate of 33%.

- No change in DIRT, exit tax or Capital Gains Tax (CGT) rates

No change announced in DIRT or exit tax rates, which remain at 41%, or in the standard CGT rate of 33%.

- Reduction in USC rates and bands will deliver additional net income of up to €900 per annum.

Some USC bands have been increased and some rates reduced, meaning an increase in net income of up to €900 per annum.

- Introduction of an income tax credit for the self-employed and proprietary directors.

- Proprietary directors and their spouses/civil partners have traditionally been denied the PAYE tax credit of €1,650, despite paying taxes under the PAYE like other employees.

- A maximum €550 income tax credit for earned income is being introduced in 2016 for the self-employed and proprietary directors, equivalent to increasing the standard rate bands for these taxpayers by €2,750.

- Reduced Capital Gains Tax (CGT) rate of 20% to apply to the sale of businesses.

A reduced CGT rate of 20% is to apply from the 1st of January 2016 onwards on the sale in whole or in part of a business up to an overall limit of €1 million in chargeable gains.

Budget 2016 Summary

- Pension levy ends in 2015

The Minister has confirmed that the much disliked pension levy ends this year with the final 0.15% levy applying at 30th of June 2015 values. No levy will apply from 2016 onwards.

- Reduction in USC rates and bands

The standard USC rates and bands (for an individual under 70 who does not hold a medical card) have been reduced as follows:

| 2015 | 2016 | ||

| Income band | USC rate | Income band | USC rate |

| Up to €12,012 | 1.5% | Up to €12,012 | 1.0% |

| Next €5,564 | 3.5% | Next €6,656 | 3.0% |

| Next €52,468 | 7.0% | Next €51,376 | 5.5% |

| Balance | 8.0% | Balance | 8.0% |

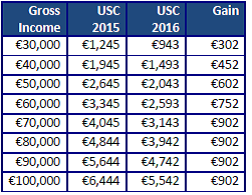

The change in USC bands and rates shows the following difference in USC liability as between 2015 and 2016 at different levels of gross income:

Sole traders and partners in a partnership who have income in excess of €100,000 pay additional (to the 8% rate above) USC of 3.0% on such income in excess of €100,000; this continues for 2016.

The 3.5% rate currently applying to the over 70’s with income of less than €60,000 is reduced to 3.0%.

- Increased CAT Threshold

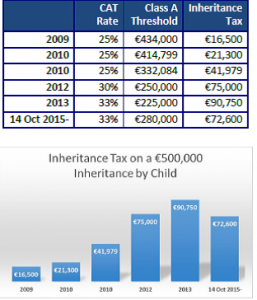

The current Class A Threshold limit (which applies to inheritances taken by child from a parent) of €225,000 is increased to €280,000 with effect from the 14th of October 2015. However there is no change in the Class B and C Thresholds of €30,150 and €15,075.

While the increase in the Class A Threshold is welcome, Inheritance Tax liabilities are still substantially higher than back in 2009, due to a combination of an increase in the tax rate and reduction in the Thresholds. Consider the Inheritance Tax liability on an inheritance of €500,000 by a child from a parent, assuming the full Class A Threshold is available to the child:

- Introduction of an Earned Income Tax Credit for the self-employed and proprietary directors.

Proprietary directors, and their working spouses/civil partners, have traditionally been discriminated against because although they paid their income tax under PAYE like everyone else, they could not claim the PAYE tax credit of €1,650 available to all others paying income tax under PAYE.

From 2016, the self-employed and working proprietary directors and their working spouses/civil partners will be entitled to a €550 income tax credit against income tax on their earned income. The effect of this is similar to an increase in the standard rate band of €2,750.

In the case of a family company the tax credit will be available to each employee who is not entitled currently to the normal PAYE tax credit, so that a husband and wife both working in the business and drawing Schedule E income from it, will each be entitled to a maximum €550 tax credit, if they have sufficient taxable income.

The tax credit may encourage more spouses/family members to work in family businesses, thereby increasing retirement funding potential.

An interesting side note: the tax credit will not reduce remuneration for pension funding purposes.

- A reduced 20% Capital Gains Tax (CGT) rate on the sale of a business

The Minister announced that a reduced CGT rate of 20% will apply from 1st January 2016 to the sale in whole or in part of a business up to an overall limit of €1 million in chargeable gains.

- State Pensions increase by €3 per week

The last increase in the State Pension was in 2009, 6 years ago. All State Pensions are to be increased by €3 per week from 1st January 2016 onwards. This will bring the maximum State Pension Contributory to €233.30 per week from its current €230.30 per week:

The Child Benefit will also increase by €5 per month to €140 per month per child from 1st January 2016.

- DIRT/exit tax & Capital Gains Tax (CGT) rates continue at 41%?

No change has been announced in the DIRT or exit tax rates of 41%, or the standard rate of Capital Gains Tax of 33%.